Newsletter

July

Topics in this issue:

|

| ||

|

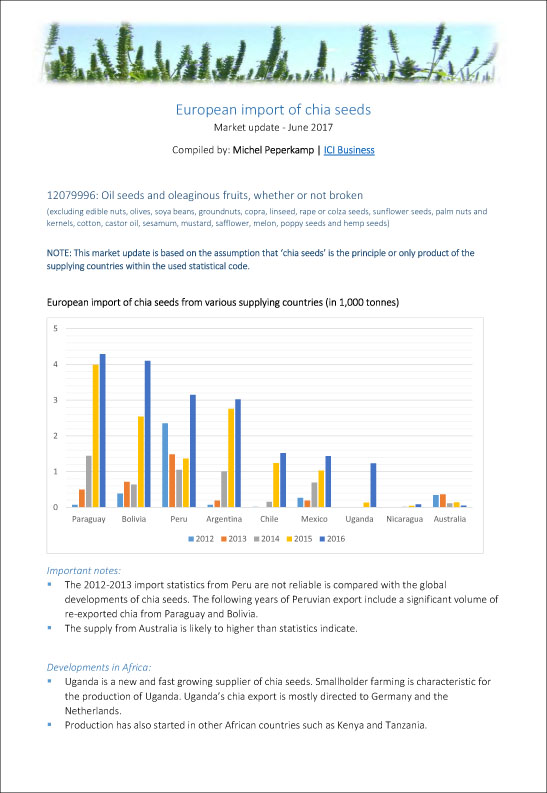

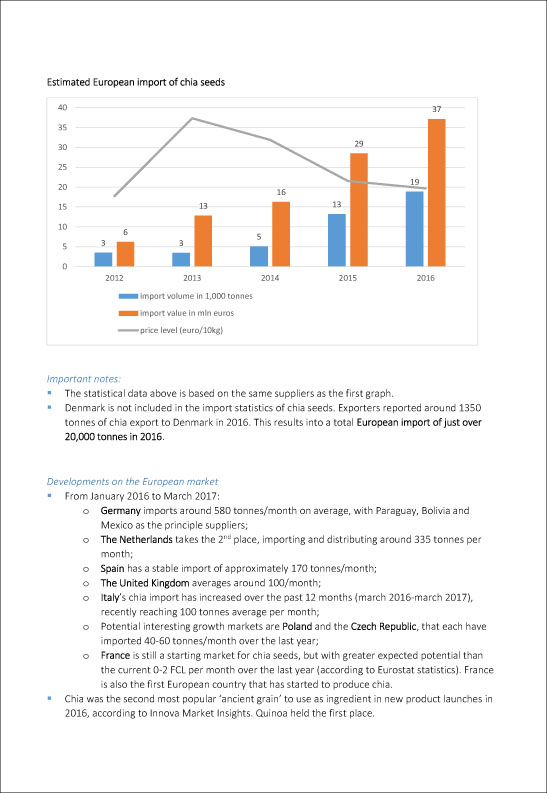

This year the Chia market is difficult to judge. Currently it is reported that the crop in the main cultivation areas is significantly lower than in previous years. The reason for this is the lack of motivation of many farmers and producers to cultivate Chia. This development is triggered by the extreme price decline in the previous year, after the market was saturated with poor qualities. The Chia boom in 2013/2014 with prices of over 6 € / kg was followed by the crash of the prices to under 1,50 € / kg in 2015. Expected quantities 2017 We expect prices to continue to rise in the coming months. From today's perspective, we recommend to conclude contracts until mid-2018. We will visit the main producers in Bolivia in August and report on the local situation. Alexei Justiz 5.7.17 The attached report on the development of the European Chia market was prepared with the kind support of the CBI *. * The CBI, Center for Import Promotion from Developing Countries, is part of the Ministry of Foreign Affairs of the Dutch Government |

||

|

to the top

|

||

| ||

|

At the end of 2016, Guar prices were at a low level. For no obvious reason, however, they started to rise in February and increased by about 35% by May. Most likely prices were driven by the high amount of orders from the oil sector and a scarcity of the raw material.

It was assumed that prices would continue to rise further on, but they began to decrease and finally fell by about 12%. Despite the decline prices were still around 15% higher than the level at end of 2016. Dietmar Neupert 5.7.17 |

||

|

to the top

|

||

|

| ||

Development of the Guar split prices January 2016 until July 2017 |

||

|

to the top

|

||

| ||

|

We have reported several times that the prices for Xanthan gum have fallen dramatically because of the competition amongst Chinese producers. Meanwhile it is obvious that there are no winners in this prize fight. Fufeng, who is still the market leader has gradually increased prices over the last few weeks, and the others followed immediately, because the long-lasting loss situation was not sustainable for any producer. These multiple price increases are only a first step in Fufeng's view. Supposedly Xanthan gum is still sold under manufacturing costs. Dietmar Neupert |

||

|

to the top

|

||

|

| ||

|

||

|

to the top

|

||

|

| ||

|

||

|

to the top

|

||

| Neupert Ingredients GmbH In der Boerse 9 | D-21441 Garstedt | Germany Tel.: +49 4173- 51591 - 0 | Fax: +49 4173 51591 - 99 E-Mail: info@neupert-ingredients.de |

|

||

| You don‘t want to get our newsletter anymore? Please click here to unsubscribe |